You just heard that a house you love is coming on the market. It's exactly the size/price/location you want for your first, or next, home. But with all this talk of recessions and inflation and higher interest rates, is now the time to buy? More importantly, is now the time to sell? Should you wait for next year? Should you at least wait for the next "selling season?" It's a lot to think about and buying a home is a much bigger deal than your choice to buy that ill-advised fast fashion top you bought that still has the tags on. Stacy Esser of SEG Realty has insight and some good news that will get you into that house of your dreams faster than that top will go out of fashion.

First of all, an increase in interest rates doesn't necessarily mean an increase in mortgage rates. In fact, after a peak in June 2022, mortgage rates have been inching slowly downward. So, if that house you've been eyeing with the big lot and the recent upgrades comes on the market, you should be able to find a mortgage rate that will work for you. Additionally, recessions tend to drive mortgage rates down. So, not that we're hoping for a recession but if we are, in fact, entering into one, there's at least one silver lining.

First of all, an increase in interest rates doesn't necessarily mean an increase in mortgage rates. In fact, after a peak in June 2022, mortgage rates have been inching slowly downward. So, if that house you've been eyeing with the big lot and the recent upgrades comes on the market, you should be able to find a mortgage rate that will work for you. Additionally, recessions tend to drive mortgage rates down. So, not that we're hoping for a recession but if we are, in fact, entering into one, there's at least one silver lining.

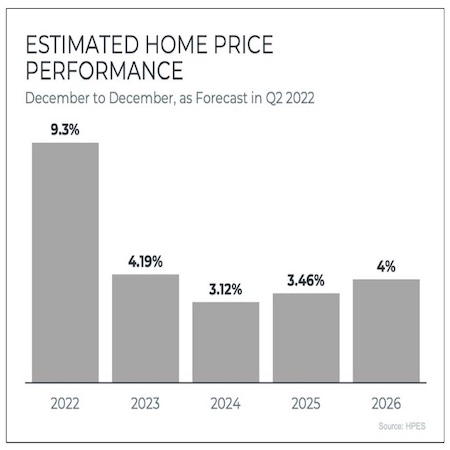

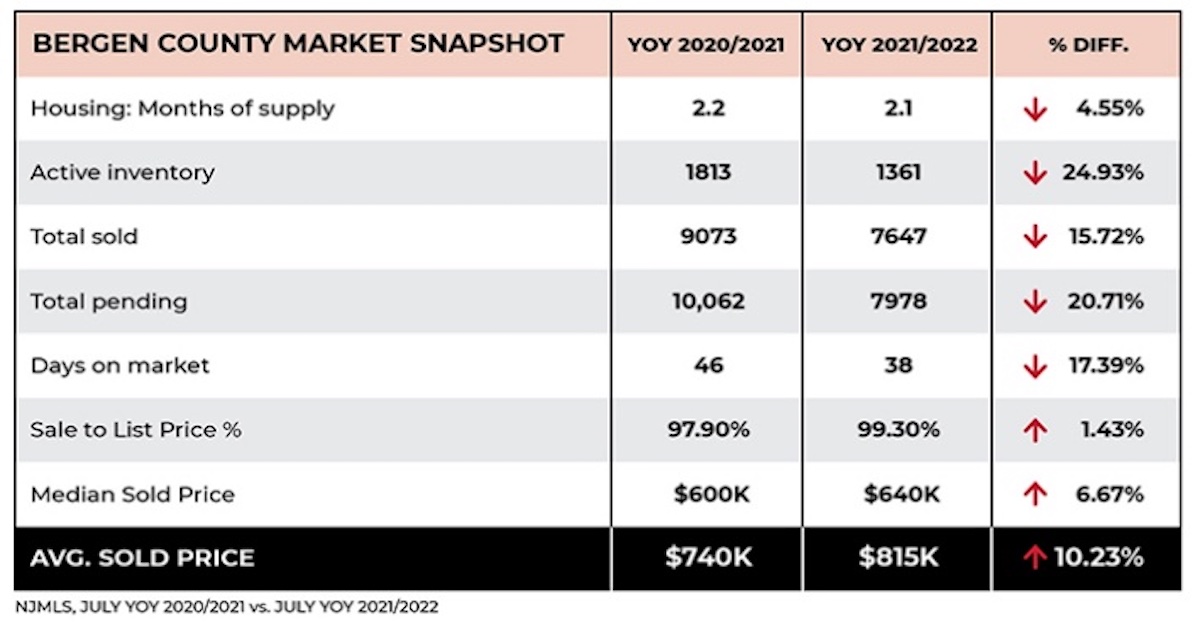

Okay fine, but what about home values? Will you be able to sell your house for what it's worth? (Or more. More would be fine too.) Believe it or not, the housing market has seen and is seeing increases in home values. Part of this is still due to relatively low supply and relatively high demand even though both of these factors are also returning to pre-pandemic "normal." But it's also important to remember that "normal" in 2017-2019 was still really great. So, even if things go back to those levels, it's still a very favorable market.

Well sure, but you're not the only one who thinks that house down the street is the perfect next home for you, right? Right. You're probably going to have some competition. In northern New Jersey, there is currently not enough inventory to meet demand. Nationally, the average is 4.2 offers per home and over half going over the asking price. So, have your finances in order before you make that offer and try to lock in an interest rate as soon as possible so you know exactly what you are willing to pay for your next home. On the bright side, if you're also selling a home, it's just as likely to go for top dollar in a bidding war as the house you want to buy.

Oh, one last piece of good news. Buying seasons are no longer a thing. So, you don't have to cool your jets until the new year and then jump on the "spring season." You can list your house right this minute and, all things being equal, be just as likely to get offers now.

Oh, one last piece of good news. Buying seasons are no longer a thing. So, you don't have to cool your jets until the new year and then jump on the "spring season." You can list your house right this minute and, all things being equal, be just as likely to get offers now.

So, what's the bad news? Well, even though inventory is low, buyers aren't just snapping up any old property they can find. You're going to have to do the work to make your home appealing to buyers. It's really smart to work with an agent who is familiar with your market to arrive at a price that is acceptable to you and attractive to buyers.

Also, though experts don't think this is a bubble, they do caution that this is probably the last big-growth year for a while. Which means if you're ready to move now, get going. If you're not, you might not see the eye-popping offers of the past few year but because of the lack of inventory or new homes being built in our area, prices will continue to grow, just at a slower rate.

Bottom line? Don't be scared off by rising interest rates or fear of recession. Get your finances in order and have a clear idea of both what you are willing to spend for a new house and how much your current home is worth. Put in the work to make your home appealing to buyers. And most importantly, find a real estate professional like Stacy Esser or one of her associates whom you trust and who you know will work for you. Then, what are you waiting for? Go find yourself a brand new home sweet home.